Income Tax

We will provide income tax return preparation, Revised return, Responding to Department notices and solving other Income Tax related issues.

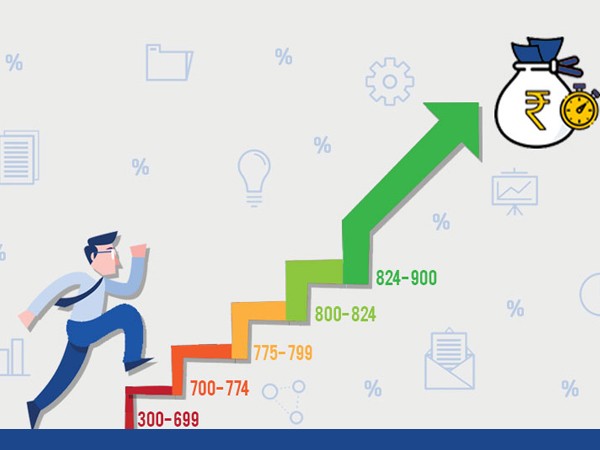

CIBIL Score is an important component of your credit profile that gives potential lenders a quick idea of your credit worthiness. Credit rating for individuals is nothing but your credit score. In addition to a credits core, bureaus also provide a credit report which indicates your credit and payment behaviour.

Credit Information Bureau (India) Limited, commonly known as CIBIL, is India’s first Credit Information Company or Credit Bureau. It maintains records of all credit-related activity of individuals and companies including loans and credit cards. The records are submitted to CIBIL by registered member banks and other financial institutions on a periodic (usually monthly) basis. Based on this data, CIBIL issues a Credit Information Report or CIR (commonly referred to as a credit report) and a credit score.

CIBIL score is calculated based on your credit behavior as reflected in the ‘Accounts’ and ‘Enquiries’ section of your CIR. CIBIL scores are important when it comes to availing loan approvals.

Thewealthbridge.in is web portal of the Virutchamwealth Bridge Private Limited is one stop business setup and consulting company, managed by specialized team of Business Analysts,Company Secretaries, Chartered Accountants, Corporate Lawyers and Financial Professionals company headquartered in Vellore,Tamilnadu, India. Having known for our quality of services, delivering the projects on time, we have clients spread across the globe

We are committed to delivering value to our clients and ensuring long term success. Reach out to us to improve your business in global market, innovation ,reduce costs, implement new techniques, manage risk and governance. For us, the most important differentiator is not ‘what’ we do, but ‘how’ we do

We will provide income tax return preparation, Revised return, Responding to Department notices and solving other Income Tax related issues.

Our Professionals Will help you in getting your business licenses and Business licenses necessary for smooth running of businesses

we will Provide Funds for both personal and Business. Our funding system gives a credit line facility, enabling you to expand your business to new heights

We will make your business to GST Compliance. Returns are required to be filed digitally online through a common portal to be provided by GSTN

Your CIBIL score shows the lender just how creditworthy you are. If you have a good CIBIL score or report, the lender won’t hesitate before granting a loan. But a bad CIBIL score might lead to loan rejection as the lender is unsure of your creditworthiness.

Low or a bad CIBIL score can hamper your chances of getting a credit card. If you’ve defaulted previously on any of your credit cards, it would have been recorded on your CIBIL report and this does not hold well with the banks and financial institutions. Banks/financial institutions are more likely to approve your application for a credit card when you have a decent CIBIL score.

Higher the CIBIL score, lower the interest rates. If you hold a good CIBIL score/report you have a better chance at getting lower rate of interest on your loans and credit cards. A good CIBIL score will grant you the power to negotiate.

A good CIBIL score will ensure that you get a housing loan without any hassles whatsoever and the same things holds true for availing a place on rent.

Banks and financial institutions are favorable to individuals with a good or high CIBIL score. This will ensure that you get approval for higher limits from the bank or financial institutions.

We Help You To Form Your Company In A Simple Way Wealth Bridge Will Making More Possibilities which aims at providing much-needed funds to businesses across the trading and service industry

2nd Floor, #23, 8th East Main Road

Gandhinagar, Katpadi, Vellore

(+91) 416 2241199

(+91) 86677 53901

# 10/1, Thiruthani High Road ,

Upstairs to Central Bank ,Jothi Nagar,

Arakkonam , TamilNadu - 631003

Phone:+91 6381184522 , +91 8012747723.

No 126, MBT Road, Mahaveer Complex,

First Floor, Muthukadai,

(NearDarling bakery) Ranipet - 632401

Phone : +91 417 2295006 +91 86675 42148